Gini Pay Photo Payment – click, check, pay.

Transfer a bill in seconds with the number one feature in the largest German retail banking apps.

Pay your bills with a snap.

Gini Pay Photo Payment turns your mobile camera into a smart time-saving machine. Optimal user experience and highly specialized AI have made our automagic payment process the new industry standard, convincing millions of users every day. No matter if you make a snap of your bill, scan the giro code or share a digital receipt with your banking app – wiring money has never been so easy.

Gini Pay Photo Payment – How It Works

Transfer money

the smart way.

Pay your bills by scan without typing the recipient’s details – the Gini Pay photo transfer has become the standard in German banking apps. Regardless of your invoice is a scan, e-bill, or are photo of your mobile camera, all relevant payment details automatically get extracted to prefill the transfer form and save your time.

Share With Your Banking App

PDF or screenshot?

Share it with your mobile banking app.

The payment details came by e-mail? A friend sent his bank account details in a chat?

Open the PDF or screenshot from your gallery, and select the banking app by the share-with-button – done.

The photo payment extracts the payment data from various formats, whether PDF, JPEG, PNG, or GIF, in the most convenient way.

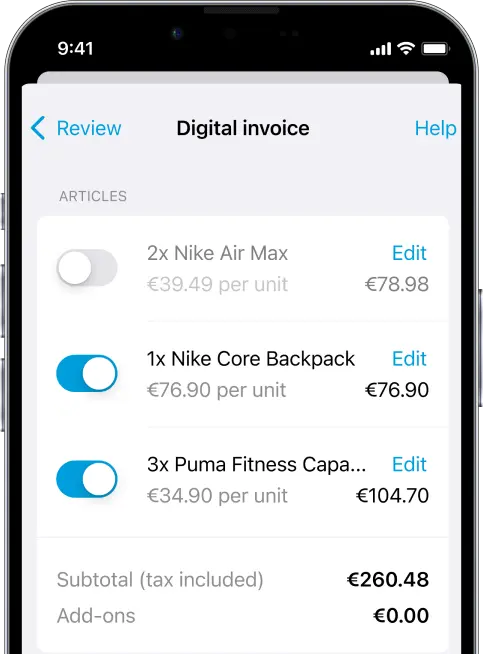

Gini Pay Photo Payment – Upgrades

Photo Payment 2.0: Purchase on account, paid smartly.

Mobile banking must not stand still: Today, mobile-first also means customer-first. That’s why we strive to make the Gini Pay Photo Payment even more convenient and compelling – with useful add-ons to simplify life.

Gini Pay Connect – Benefits

The No. 1 feature in mobile banking.

Gini Pay photo payment is the digital hero of leading German banks. Unmatched in terms of extraction quality, speed, and security, the photo payment is the favorite convenience feature of all bank customers. After all, everyone deserves a magic moment.

92,900,000+ documents

scanned & paid in 2023

91.8% accuracy

in data extraction

2.1 seconds

processing time

5,131,494 users

monthly active users in 2023