✓

Your bank turns into a smart payment machine –

with Pay Connect.

Making payment easier than ever.

Powered by SEPA Request-to-Pay.

Bringing mobile payments back to banks.

Today, banks have lost mobile payments to other players, such as tech companies. To remain in the pole position for customers regarding financials, we need to bring the bank and bank customers closer together again. The right tool for this is already in the palm of our hand: the mobile banking app. Making it the center of every mobile payment, we combine the retail bank’s trust with today’s technology.

Gini’s payment initiation services, such as SEPA Request-to-pay and Gini Pay Connect, not only leave users excited through their simple handling. At the same time, they increase the frequency of use and thus also customer loyalty and new sales potential. Abracadabra! Welcome to mobile payment powered by Gini.

Percentage of respondents who have used these online payment services in the last 12 months

(Source: Statista Global Consumer Survey, 2022)

Customer centric

Built on years of trust. Extended with modern experiences.

Trust is the most critical asset in financial and payment matters. That’s why more than half of Germans are interested in paying with their checking account’s bank online, and more than 20% would even replace their preferred third-party payment provider with it.

Gini Pay Connect makes retail banking payments magically simple: click in checkout, pay with the banking app – done! Each payment transaction is initiated from the third-party interface and processed through the trusted bank’s mobile banking app. Along the way, the transaction list becomes a digital archive because purchase receipts are displayed directly with the request-to-pay in the app and attached to the transaction.

This turns the banking app into a one-stop solution for your users – unconditional trust included.

Assuming it would be offered when buying online, would you be interested in paying with your banking app at the checkout?

E-Commerce

Usecase E-Commerce

Checkout with your retail banking app, now easier than ever.

When paying is as easy as shopping, it’s payment initiation from Gini. Whether from an app, browser or by QR payment code, your banking app turns into your central payment tool.

Thanks to SEPA Request-to-Pay, the merchant triggers the payment request, including the invoice, and pushes it directly into the banking app. Authenticate, authorize – done. It allows customers to pay with their checking account without having to share their bank details at checkout. And because every transaction comes with a digital invoice, the transaction list evolves into a valuable receipt collector.

On top of that, the payer’s bank can leverage new revenue potential: from installment payments to Buy Now, Pay Later offerings to selling embedded insurance, the banking app becomes a profitable customer center.

Insurance

Usecase Private Health Insurance

Tomorrow’s payment requires ideas. And a touch of magic.

Gini Pay Connect connects banks with insurance companies for customers. The App2Bank integration makes it possible to read the payment information when submitting invoices in the insurance app, transfer it to your banking app with one click, and fill in the payment information fully automatically. The integration into the app using SDK combined with Artificial Intelligence as SaaS succeeds with almost no effort. This enables payments using the user’s bank account without passing data to other payment service providers.

For bank customers, it also works the other way around: after paying via photo payment, the hand-over into the insurance app can be continued instantly with one click for an automagic customer experience.

The banking app opens doors to an ecosystem full of possibilities and added value.

Other industries

Usecase Other Industries

Payment becomes automagically simple.

Payments with checking bank accounts can now be offered by anyone – Payment Initiation with Gini Pay Connect and SEPA Request-to-pay allow seamless requests and transfers of payment details into mobile banking apps. This makes appointment transfers, pre-payments, and direct debit much easier.

Have an exciting use case in mind for your business? Contact us for more information!

Benefits

What excites customers won’t hurt the business.

As a proven bank partner for decades, we move banking to the digital forefront. We help to better understand bank customers, optimize revenue models, and generate new business opportunities – all with the banking app.

SEPA Request-to-Pay

Your one-stop shop for payment initiation.

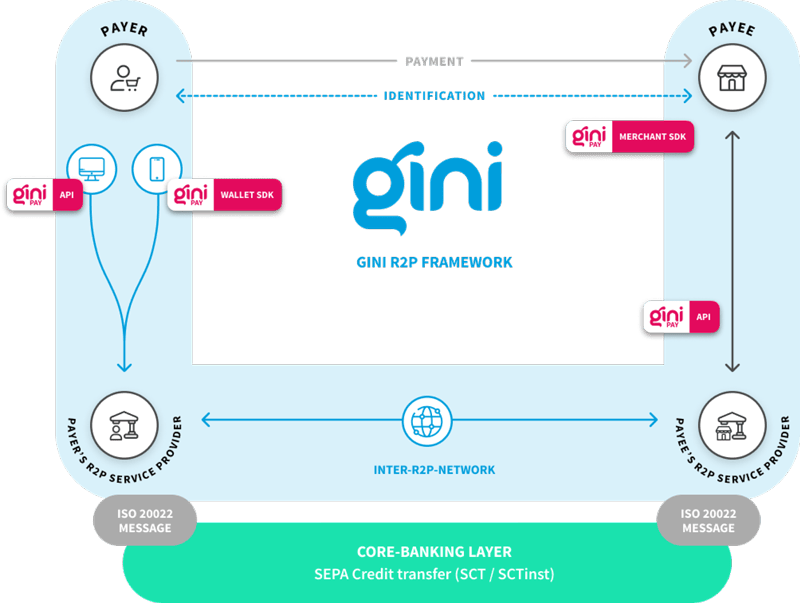

We take care of the payer side (left) and ensure the SRTP presentation step via SDK or API, homologated as the first Technical Service Provider in Germany. For banks offering cash management services to corporates and merchants, Gini takes care of your role as Payee’s R2P Service Provider smoothly so that Payees can send and reach Payers. And, of course, we ensure to deliver the right message on the right device.

Smart!

Integration

Easy payment?

Easy to integrate!

If you want to do your digitization homework and offer your banking app users a seamless mobile payment experience, you don’t need to fear technical hurdles: We get it done! Because Pay Connect is custom-made for all requirements and platforms. The implementation into the banking app is done within a few days via an extension of the existing SDK. So simple, so good.