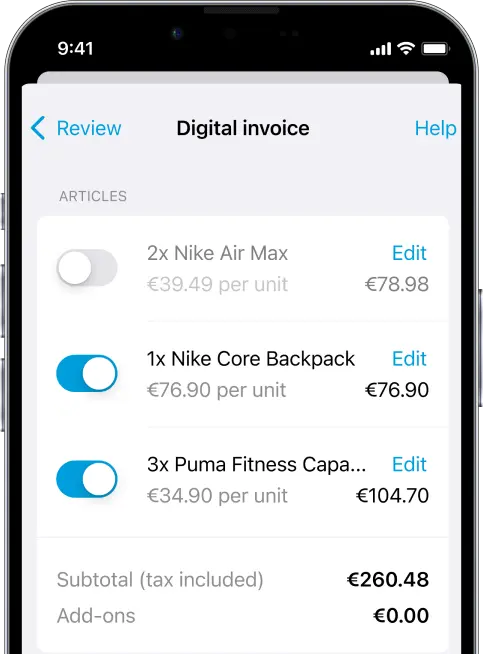

Photo payment – click, check, pay

Welcome to the market leader in smart payments.

Turns wire transfers into a piece of cake.

In the past, brick-and-mortar bank branches knew their customers in person. In times of increasingly new players in the payment market, we at Gini ensure that the customer’s connection is never lost, shaping it even more direct, innovative, and profitable.

Digital services such as simple transfers by photo and PDF save time and delight customers. And these customers remain loyal to their bank and recommend their bank significantly more often.

More than 5 million

active photo payment users in December 2023 alone

More than 120,000 hours

saved time for users in one month through our automagic payments

2x increased usage

of bank customers opening their banking app

Mission easy payment

Paying bills as quickly as taking a snapshot.

Today’s customers have neither the time nor the desire for complex payment processes. This is why we have made paying as easy as shopping: click, select your bank account, approve, and done. We take care of the rest – completely automatically. Gini combines the knowledge from millions of extractions with the best AI – for the optimal user experience without using PayPal & Co.

Benefits for bank customers

Benefits for banks

Best in class

The unmatched #1 banking feature.

Gini Photo Payment is the mobile banking digital champion: unmatched in extraction quality, speed and security thanks to learning AI with the experience of over 50 million processing operations per year and the continuous optimization of hardware, software, and our proprietary OCR technology.

That’s why our convenient photo payment is also the favorite feature of all bank customers – after all, everyone deserves a magic moment.

92,900,000+ documents

scanned & paid in 2023

91.8% accuracy

in data extraction

2.1 seconds

processing time

5,131,494 users

monthly active users in 2023

Best extraction accuracy of the required payment information:

97.5%

IBAN

82.5%

Transfer

reference

95.5%

Recipient

information

91.5%

Amount to pay

Benefits

Once the photo payment is in, the banking app got it down.

Next to the financial overview in the transaction list, photo payment is the second most used feature in banking apps. That means: photo transfer pushes banking app usage, interactions, time spent in the app, return rate, and downloads. And a sticky app is an important prerequisite for the bank to expand its service offering and attractiveness further.

1 try =

plus 26 touchpoints

Once customers have tried the Gini photo payment, they use it an average of 26 times a year.

In the best company

Best banks build on the best photo payment.

The Gini photo payment has been defining the new industry standard, powered by its uncompromisingly positive user experience and one-of-a-kind AI. Our technology works in the banking apps of almost all of Germany’s top retail banks.

FAQ

You have questions, we have the answers

7.24 mio.

minutes

120.680

hours

5.028

Days

saved time for all bank customers in one month

Base: 10,103,489 million transfers in December 2023.

Average time required for a transfer on a mobile phone until TAN approval:

a) by hand 1:14 min b) by photo transfer: 31 sec