Pay anywhere with your bank – powered by SEPA Request-to-pay.

Because trust is the most crucial currency when paying.

Thanks to SEPA request-to-pay, the banking app becomes a payment machine.

To sustainably position the bank as the number one for customers when it comes to money, a banking app today must also meet the daily needs for payments.

Gini’s SEPA Request-to-Pay function is easy to use and not only ensures enthusiastic users but also increases the frequency of use and, thus, customer loyalty. This makes payment a breeze and available everywhere – without any third-party payment provider. And the cherry on the cake: the security of your retail bank is always included.

Customer centric

Payment request incoming, confirmed in the banking app.

Ka-Ching!

Users don’t want hidden fees and uncertainty when paying online. That’s why they can now do it with their bank. Thanks to the SEPA Reauest-to-pay Payment Initiation Scheme, a payment agreement is made between the sender and recipient. This is then automatically authorized in the banking app and the bank transfer is executed. The result makes everyone happy. And payment finally becomes what it should feel like today: easy!

Surprisingly easy

Dear retail banks, welcome back in payment.

From now on, customers can pay online directly from their bank account without worrying about security. The direct submission of the payment request into the banking app doesn’t require tedious registration and identification processes as with other services. The SEPA scheme, valid throughout the EU, not only offers a much more cost-efficient and resource-saving way of making payments but also makes it possible to cover all modern and convenient features like wallets.

And everything is available in the familiar user interface of your checking account bank.

High conversion rates

because the bank logo is visible in the payment mix of the checkout process

Less transaction fees

thanks to SEPA credit transfers

Available everywhere

in mobile apps, web stores, and PoS

Identification in the banking app

Strong Customer Authentication between user and merchant without signing up

Free choice of payment terms

Instant payment or purchase on account, selected by the merchant

Open network based on SEPA Rulebook

Gini R2P is based on the official SEPA Request-to-Pay Rulebook of the European Payments Council. We rely on an open and decentralized network that is open and uniform for the entire European SEPA area. Open systems scale faster, there is no central authority that has to distribute it or can even be a gatekeeper. This makes SEPA request-to-pay the optimal solution for you and your bank.

European reach through SEPA Request-to-Pay Scheme

The scheme is based on the SEPA rails that are used for payment transactions in every European country. This allows you to use SEPA request-to-pay from Gini not only locally, but throughout Europe – without any additional infrastructure or individual connections. And thanks to the open system, you also enable interoperability with other SEPA request-to-pay systems in Europe.

Chicken-egg-problem

We not only provide software, but also support as a solution provider with go-to-market. A problem that has been prevalent in payment for years: merchants wait for banks – banks wait for merchants. It’s a good thing we have a solution: thanks to over 90% market coverage in German banking apps, we can bring innovations to market quickly. At the same time, we activate relevant merchants and platforms in a targeted manner – with ready-made integrations and simple SDKs.

Portfolio of beta merchants

Our network is not only convincing on the banking side – we also have a portfolio of beta merchants. Thanks to our solutions for e-commerce, we know what keeps merchants busy and can quickly test solutions such as request-to-pay in a targeted manner. The benefits: faster incoming payments, better conversion and fewer payment defaults. In this way, we ensure that our solution is not only technically mature, but also user-friendly and practical.

Our ways to connect Payer and Payee:

App-to-App

Gini Pay Wallet – Features

App-to-App

In the context of e-commerce in native mobile apps, users can choose to pay with their own bank without sharing any information at the checkout step. Our App-to-App functionality takes care of redirecting users to their preferred bank, where they receive the Request-to-Pay message and accept it with their defined authorization method.

Web-to-App

Gini Pay Wallet – Features

QR-to-App

Gini Pay Wallet – Features

How it works

We handle SEPA

Request-to-pay for you.

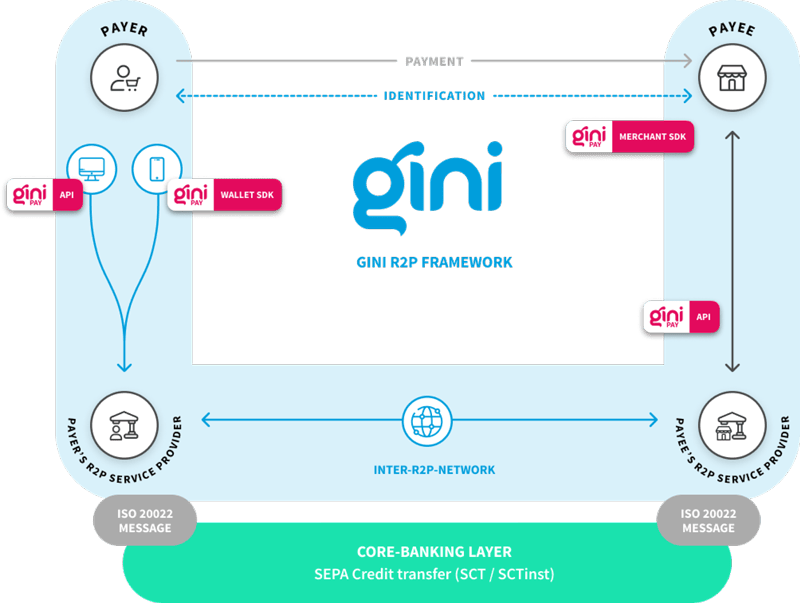

We take care of the payer side (left) and provide the SEPA request-to-pay presentation step securely to all retail bank users via SDK or API. We enable banks and PSPs that offer cash management services for companies and merchants to be seamlessly integrated into the request-to-pay process – so that payers can deposit money and recipients can receive their money directly in their current account. And, of course, each side receives the corresponding request in real time on the correct device. Simply smart!

Performance with Gini

Chicken or egg?

No question, thanks to Gini.

Paying with your bank must be a breeze. We’ve proven it before – as the largest provider of photo payments in Germany’s major retail banks, we’re taking digital banking to the next level.

Covering more than 90% of the mobile banking apps market, we roll out innovations faster than anyone else, always with the end user in mind, creating user journeys that inspire users and drive engagement.

Payment, surprisingly easy:

Integration

Easy payment,

easy to integrate.

If you want to offer your banking app users an extraordinary mobile payment experience, you don’t want to worry about technical hurdles – we get it done.

That’s why our Gini SDKs for banks and merchants are made specifically for all needs and platforms. The integration takes just a few days, and for existing banking partners, it’s a simple extension of the existing SDK. Uncomplicated, effective – automagic.