We have collected tips that can help you optimize your checkout. All tips can be implemented in just a few steps - and have a direct impact on your payment costs.

In e-commerce, economic success is decided at the checkout. Here, the choice of payment methods significantly influences the transaction costs per order. Many store operators underestimate this lever.

With QR code payment, we have created an option that supplements the checkout with a free and innovative solution. However, the cost savings fail to materialize if the selection of payment methods is incorrectly designed. The correct placement and promotion of free payment methods is the step that is often missing when it comes to an optimized checkout. We will show you how you can increase the proportion of free payment methods in the checkout with simple measures and thus reduce costs and improve conversion rates in the long term.

Reduce costs, save money: QR code payment

Why make it complicated when it can be simple: we have combined the principle of traditional prepayment with modern user guidance via a QR code. The customer scans the generated code with their banking app during the payment process. The transfer is created and executed automatically. The status is automatically reported back to the store as soon as the amount is received. As there are no costs for a classic bank transfer, there are also no transaction costs for the merchant.

For you as a merchant, this means:

- No payment fees: There are no transaction fees on your side.

- Direct receipt of payment: The payment is processed entirely without third-party providers. This ensures a simple and, above all, secure process for your customers.

- Automatic payment processing without manual verification: The rest is done automatically once the payment has been confirmed.

- Higher liquidity thanks to faster payment. With SCTInst, you receive the money in seconds, increasing your liquidity.

- No complex contractual partners or intermediaries: payment is made directly between you and your customer without redirecting.

Especially with higher-priced goods or high-margin product ranges, you can make significant savings through the checkout – provided your customers actively use this option. For this to succeed, Scan & Pay should be integrated into the checkout in a visible, understandable, and attractive way.

10 specific tips for optimizing your checkout with Scan & Pay

So, how do you increase usage? It’s very simple: with just a few minutes invested, you can optimize your checkout and achieve a cart share of up to 24%

The payment method selection page is the page on which a customer decides for or against a payment method. There is just as much that can be done right as wrong here. We have looked at numerous stores with very different integration qualities. We have collected tips that can help you to optimize your Chekout. With the following measures, you can work specifically towards higher usage. All tips can be implemented in just a few steps – and have a direct impact on your payment costs.

-

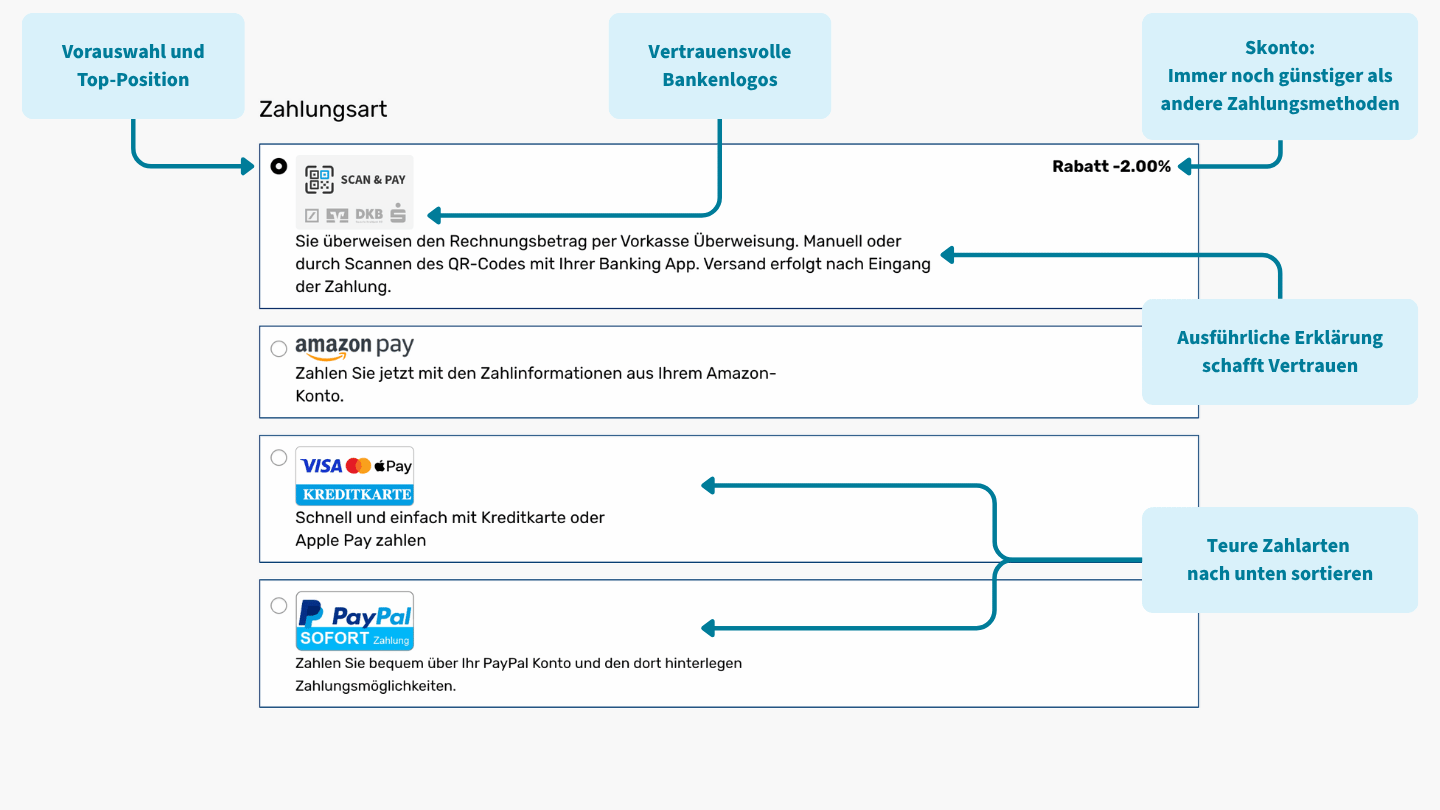

Sort payment methods logically: Visibility is key

The order of payment methods significantly influences the decision. Customers often choose the first visible option, regardless of cost or relevance. Other providers are also aware of this. Many payment plugins are automatically ranked without strategic sorting.

Tip: Sort your payment methods by cost – cheap methods should be at the top, while more cost-intensive ones should be further down. -

Set preselection: Fewer clicks, more use

If a payment method is already preselected, it is likely to be used. Every simplification counts, especially for first-time purchases or mobile purchases.

Tip: Choose the cheapest version as the default payment method to actively guide the checkout process and simultaneously simplify the checkout for your users. -

Control or hide express payments in a targeted manner

Payment methods like PayPal Express bypass the normal selection page and redirect users directly to the more expensive provider. This means that cheaper alternatives are not even considered.

Tip: Avoid express checkouts in the first step or only include them as an option in the second step. -

Keep prepayment – and combine with QR code

Many customers still rely on traditional prepayment. However, classic prepayment rarely has an appealing and simple user interface, which puts many customers off. In combination with the QR code, user guidance is optimized, but the advantages of prepayment remain. So both sides benefit.

Tip: Keep prepayment active in the checkout and add QR code payment. This way, familiar processes are retained and optimized simultaneously. -

Discount as an incentive for cost-sensitive customers

A 2% discount when selecting a certain payment method can be a strong incentive to buy – especially with higher shopping baskets. However, if you save on transaction costs as a merchant, discounts such as these are also possible without any losses. Traditional payment fees often exceed 2%.

Tip: Automatically offer a 2% discount for low-cost payment methods to actively draw attention to this option and actively guide your customers through the checkout. -

Building trust through logos and familiar graphics

Visual signals strongly guide consumers. The logos of well-known payment methods often influence the user’s choice. At this point, you can incorporate the logos of banks and payment partners to make it clear to customers that there is a well-known partner behind the QR code payment—namely their bank—which creates trust and makes it easier for them to find their way around the checkout.

Tip: Use Gini’s graphics and bank logos to strengthen your site visually. -

Presence on the “Payment methods” page and in the footer

Payment methods should not only be visible at checkout. A transparent presentation on information pages looks professional and trustworthy. In addition, your customers can think about how they want to pay in advance and make a more considered choice.

Tip: You can add the options in your footer, on the “Our payment methods” page and on FAQ or help pages. We are happy to provide you with text and graphics. -

Add payment request in order emails

Many prepayment payments are late or delayed because customers read the email later or have to make the transfer manually. A QR code can speed up this process.

Tip: Integrate the Scan & Pay QR code into the order confirmation. This way, payment can be made immediately without any media disruption. -

Advertising on the homepage and in promotional areas

Visibility creates trust. If a payment method is present before the checkout, subsequent acceptance increases significantly. Promotions or homepage banners help generate attention and build trust in a payment method.

Tip: Place Scan & Pay in a banner or information field on your homepage, possibly with the cash discount offer. -

Legal certainty through integration in general terms and conditions and data protection

Payments are a matter of trust – also legally. Correctly including Scan & Pay in terms and conditions and data protection information is essential and creates clarity and security on all sides.

Tip: Use the text modules tested by Gini for terms and conditions, data protection and user information on QR payments.

Consciously design your checkout and reduce costs in a targeted manner

Payment methods are more than just a service – they are an active part of your cost structure. Some solutions help you save transaction costs and create an optimal user experience. However, a well-designed checkout process is essential for these payment methods to be fully effective.

The 10 measures we have developed show you can strategically optimize your checkout with little effort. Just a few targeted adjustments will result in more customers actively using Scan & Pay – and you will save

At Gini, we want our posts, articles, guides, white papers and press releases to reach everyone. Therefore, we emphasize that both female, male, and other gender identities are explicitly addressed in them. All references to persons refer to all genders, even when the generic masculine is used in content.